|

| Voted Yet? Facebook sure knows. |

As anyone who has logged into Facebook today, they are bound to be bombarded by two similar but very distinctly different things on their newsfeed: people posting about their voting and Facebook making a post about each user saying they have voted. Two of the almost exact same statements, yet each having hugely differential implications for Facebook and its long term outlook and strategy in the years going forward.

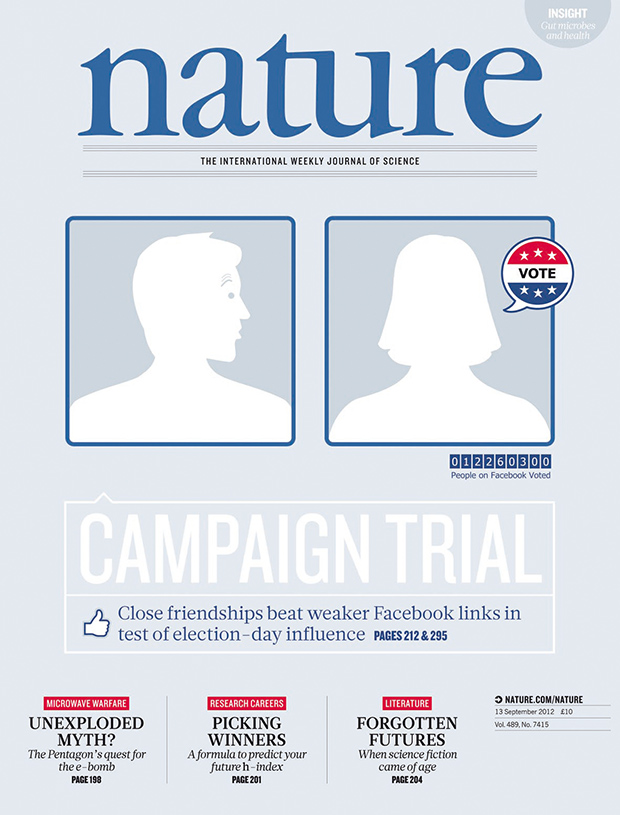

One of the good things about seeing either type of notification that your friend voted is the social influence that it has on your actions on the first Tuesday of November. According to a study done last month by researchers at the University of California San Diego, seeing the Facebook notification about voting caused an extra 300,000 potential voters to head to the polls in 2010, when turnout was at a dreadful 37%. But, Facebook's kind, if not nagging question of if you've gone to the polls and done your civic duty, isn't there primarily for building up voter turnout, but rather there to get a deeper understanding of who you are and fill in greater details about you.

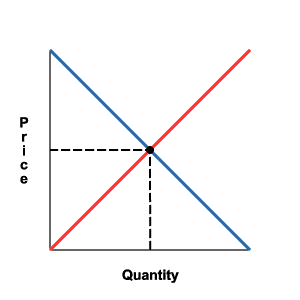

The major way that Facebook is able to make money, is by selling ad space to advertisers based on what Facebook knows about you. They get this by having you voluntarily submit information about your likes and what you do, like stating that you have voted in a past election, either by Facebooks submission, your own status update or both. What is the key difference between the two very similar statements that are posted on Facebook? In one word: targetability. When someone posts a status like the one to the left, Facebook has little ability to to use this information to allow for advertisers to target you and better target their advertisement.

The major way that Facebook is able to make money, is by selling ad space to advertisers based on what Facebook knows about you. They get this by having you voluntarily submit information about your likes and what you do, like stating that you have voted in a past election, either by Facebooks submission, your own status update or both. What is the key difference between the two very similar statements that are posted on Facebook? In one word: targetability. When someone posts a status like the one to the left, Facebook has little ability to to use this information to allow for advertisers to target you and better target their advertisement.  They can post a fleeting ad but, the status doesn't get ingrained into your profile for advertisers to better utilize. They might be able to serve an ad based on the words in your status, like "voted" but the status doesn't have any staying power to fill out your profile and who you are. Rather, by having you update your status with a binary, "Facebook Approved" status, that can either be "Yes I voted" or "No I didn't vote", Facebook allows for this to deeply ingrained into your profile. This has huge implications for Facebook in the future.

They can post a fleeting ad but, the status doesn't get ingrained into your profile for advertisers to better utilize. They might be able to serve an ad based on the words in your status, like "voted" but the status doesn't have any staying power to fill out your profile and who you are. Rather, by having you update your status with a binary, "Facebook Approved" status, that can either be "Yes I voted" or "No I didn't vote", Facebook allows for this to deeply ingrained into your profile. This has huge implications for Facebook in the future.One of the biggest things that may do is allows for advertiser to more granularly target people on Facebook. For example, advertisers could want to target those who have voted in previous elections and are Republican, two factors that Facebook has at the ready, as users volunteer them when making their profile and upon voting. While Facebook has not yet rolled it out, the ability for them to is as simple as flipping a switch on their back end. The big implications for this data is when the next round of elections rolls around. One of the big pushes over the past few election cycles has been the GOTV or Get Out The Vote message. If Facebook allows for advertisers to access the voting information, political campaigns can tailor advertisements to specifically target voters who haven't voted in the prior election, but are registered for a specific party.

I've sent Facebook a message to inquire how and if they will be using the data they are able to access for advertising purposes. I'll be sure to update the post when I hear back.